- Topics

- Webinars

- Products & Services

Welcome To Biggest Online compliance Platform By LOCGFX Pvt. Ltd.

Human Resource & Payroll

If there's a time to rethink your handbook, now. The timelines have less to do with the year 2026, the obvious time to roll out a replacement handbook, and more to do with the wave of changes that recently swept the workplace based on the change in administration and their updated policies, including the One Big Beautiful bill Act.

The OBBB Act, signed into law on July 4, 2025, impacts employee benefits and payroll administration. You should update your employee handbook to address the following changes:

· Tip and overtime tax deductions: For tax years 2025 through 2028

· Tip deduction: Employees in customarily tipped occupations can deduct up to $25,000

· Overtime deduction: Employees can deduct up to $12,500

· Employer reporting

Beyond the OBBB Act, you should also consider other updates for 2025:

· Remote and hybrid work policies

· Artificial intelligence (AI)

· Updated paid leave laws

· Anti-harassment and inclusion

· Employee classification

· Participants will learn, identify, and prepare for employee handbook violations.

· Participants will learn what policies need to be added to their employee handbook now that the OBBB Act is law

· Participants will be aware of all the new regulations that will impact their company.

· The course will identify the most common employee handbook violations and how to mitigate them.

· Learn how the Department of Labor (DOL), and the Equal Employment Opportunity Commission (EEOC) adapted to the changes based on the results of the OBBB Act

· Learn how to change regulations to be compliant with employee handbook policies

· Participants will learn which regulatory agency will focus on which regulation and mitigate the risk

· Participants will learn what policies will land them in hot water if they are not compliant.

· What policies are “must-haves” for your employee handbook?

· Learn how AI will impact the workplace and what guardrails need to be in place to avoid discriminatory perceptions

· Social media and the impact of penalties when employees choose to speak negatively about their Employer.

· Learn how your managers/supervisors can be your ambassadors in workplace compliance or your downfall

· See how training can be one of your “first line of defense” in litigation.

The OBBB Act is not the only change we will need to adjust to our Employee Handbooks. Federal regulations are not the only changes that are expected. We have learned that State regulations have superseded the Federal regulations because the regulation with the most benefit for the employee supersedes them. Many states have several changes that impact employees in state-specific and multi-state locations. When you add remote workers, there are many changes that have to be in place where compliance is key. Is your employers ready for the 2026 Employee Handbook updates?

· All Employers

· Business Owners

· Company Leadership

· Compliance professionals

· Payroll Administrators

· HR Professionals

· Managers/Supervisors

· Small Business Owners

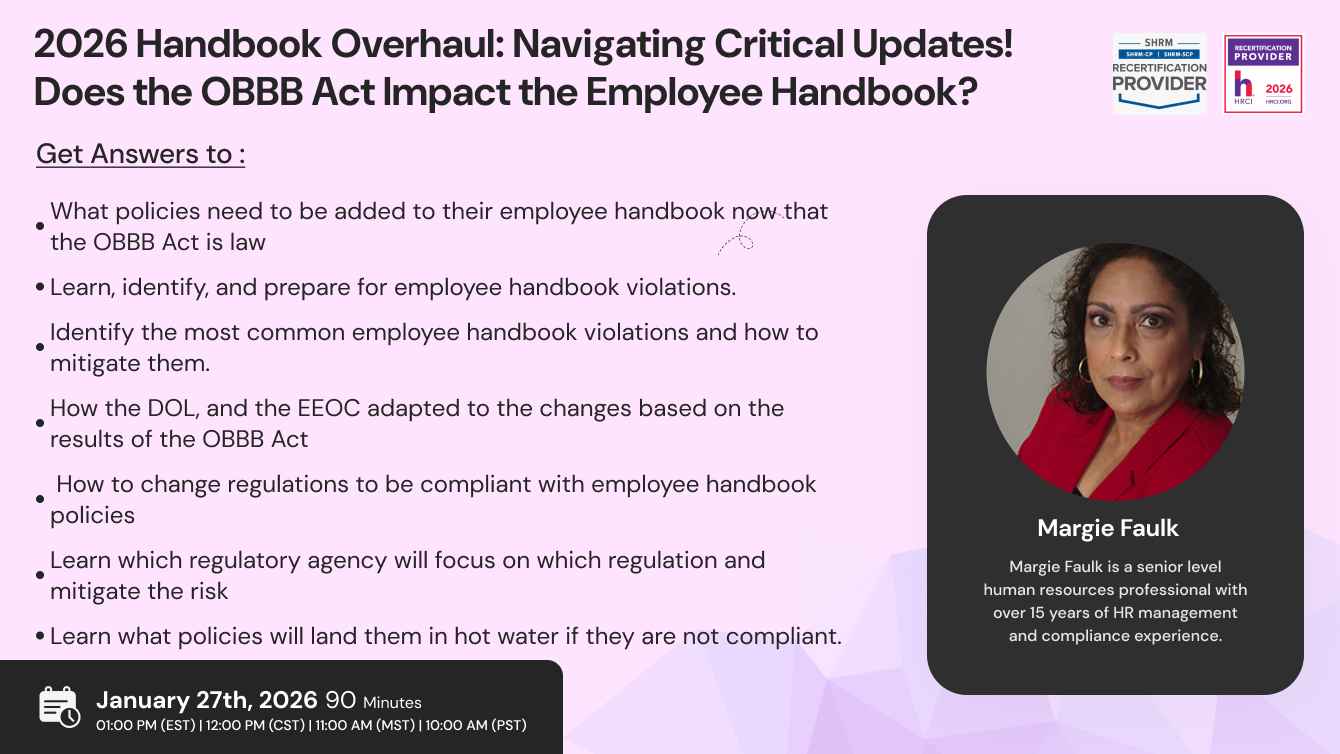

Margie Faulk is a senior level human resources professional with over 15 years of HR management and compliance experience. A current Compliance Advisor for HR Compliance Solutions, LLC, Margie, has worked as an HR Compliance advisor for major corporations and small businesses in the small, large, private, public, Non-profit sectors and International compliance. Margie has provided small to large businesses with risk management strategies that protect companies and reduces potential workplace fines and penalties from violation of employment regulations. Margie is bilingual (Spanish) fluent and Bi-cultural. Margie’s area of expertise includes Criminal Background Screening Policies and auditing, I-9 document correction and storage compliance, Immigration compliance, employee handbook development, policy development, sexual harassment investigations/certified training, SOX regulations, payroll compliance, compliance consulting, monitoring US-based federal, state and local regulations, employee relations issues, internal investigations, HR management, compliance consulting, internal/external audits, and performance management. Margie’s unique training philosophy includes providing free customized tools for all attendees. These tools are customized and have been proven to be part an effective risk management strategy. Some of the customized tools include the I-9 Self Audit. Correction and Storage program, Ban the Box Decision Matrix Policy that Employers can provide in a dispute for allegations, Family Medical Leave Act (FMLA) Compliance Guide, Drug-Free Workplace Volatile Termination E-Book and other compliance program tools when attendees register and attend Margie’s trainings. Margie holds professional human resources certification (PHR) from the HR Certification Institution (HRCI) and SHRM-CP certification from the Society for Human Resources Management. Margie is a member of the Society of Corporate Compliance & Ethics (SCCE).

Compliancevent is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.5 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please visit - portal.shrm.org.

This webinar has been approved for 1.5 HR (General) re-certification credit hours toward California, GPHR, HRBP, HRMP, PHR, and SPHR recertification through the HR Certification Institute.

The use of this seal is not an endorsement by the HR Certification Institute of the quality of the activity. It means that this activity has met the HR Certification Institute’s criteria to be pre-approved for re-certification credit.

Sign up now on compliancevent.net. Visit compliancevent.net/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer compliancevent to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on compliancevent.net today!

Go for the topic of your keen interest on compliancevent.net. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore compliancevent offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

compliancevent offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? compliancevent has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

compliancevent brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to compliancevent webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!