- Topics

- Webinars

- Products & Services

Welcome To Biggest Online compliance Platform By LOCGFX Pvt. Ltd.

Banking, Finance, Accounting & Taxation

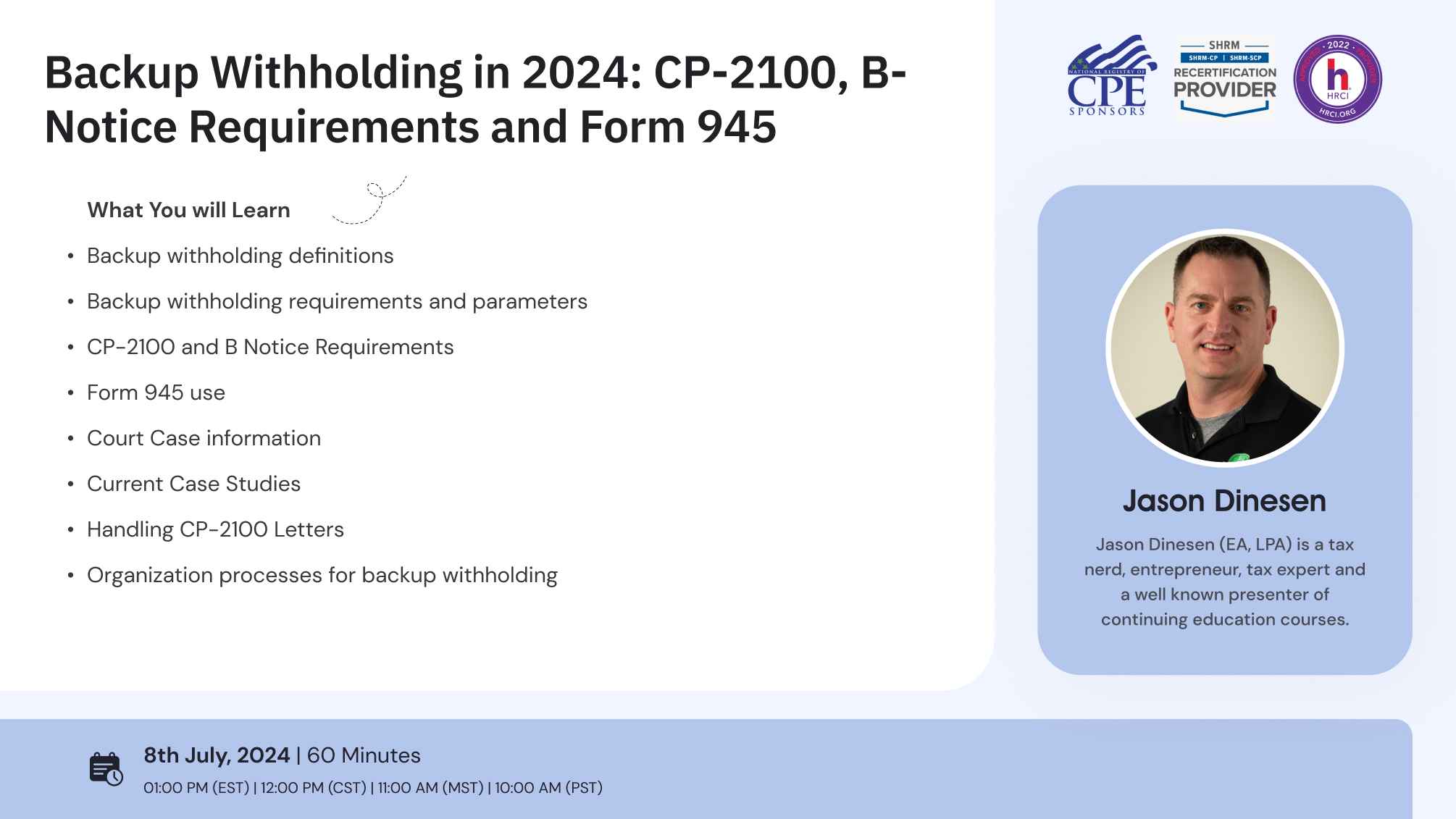

This training is all about backup withholding – the forgotten piece of the 1099 world. Backup withholding is income tax withholding on payments to contractors (or other 1099’able payments). You’ve probably heard of backup withholding, or at least seen the box on the 1099-NEC or 1099-MISC for “federal income tax withheld,” but most people have never really thought about what this means. That’s not speculation – the Treasury Inspector General has studied the issue of businesses who should be doing backup withholding and who are not doing it – it happens over 400,000 times a year.

Backup withholding is required in situations where you don’t have your contractor’s taxpayer ID number at the time you pay them, and in certain CP-2100 letter situations (if the contractor doesn’t reply to your B Notice within 30 days and you pay them again). This training will dive into backup withholding, when it’s required, how you report it (Form 945), and what happens if the IRS comes calling. We will also look at a recent court case where the IRS tried to assess $1.2 million against a small business that didn’t do backup withholding when it should have.

- Backup withholding definitions

- Backup withholding requirements and parameters

- CP-2100 and B Notice Requirements

- Form 945 use

- Court Case information

- Current Case Studies

- Handling CP-2100 Letters

- Organization processes for backup withholding

- Define what backup withholding is

- Understand the situations where backup withholding needs to be done

- Understand how you do backup withholding

- Understand how you report backup withholding (Form 945)

- Understand the IRS’s perspective of audits of backup withholding, and the perspective of courts

- Understand best practices to avoid problems, such as proper use of Form W-9

While backup withholding is required for contractors with whom you work in certain situations, many organizations do not complete their end of the requirements effectively. Neglecting backup withholding can have serious consequences for your organization and clients. This webinar will ensure you understand the requirements, and can ensure you meet your organization’s and client’s needs to comply with IRS requirements.

- Accountants

- CPAs

- Tax Preparers

- Bookkeepers

- Enrolled Agents

- Office Managers

- Small Business Owners

- Entrepreneurs

Jason Dinesen is the President of Dinesen Tax & Accounting, P.C., a public accounting firm in Indianola, Iowa. Jason prepares over 200 tax returns every year and deals with a variety of situations ranging from individual taxes to business taxes. He has been presenting since 2012.

NASBA -

Compliancevent is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its web site: www.nasbaregistry.org.

SHRM -

Compliancevent is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.0 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please visit - portal.shrm.org.

HRCI -

This webinar has been approved for 1.0 HR (General) re-certification credit hours toward California, GPHR, HRBP, HRMP, PHR, and SPHR recertification through the HR Certification Institute.

The use of this seal is not an endorsement by the HR Certification Institute of the quality of the activity. It means that this activity has met the HR Certification Institute’s criteria to be pre-approved for re-certification credit.

Sign up now on compliancevent.net. Visit compliancevent.net/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer compliancevent to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on compliancevent.net today!

Go for the topic of your keen interest on compliancevent.net. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore compliancevent offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

compliancevent offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? compliancevent has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

compliancevent brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to compliancevent webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!