- Topics

- Webinars

- Products & Services

Welcome To Biggest Online compliance Platform By LOCGFX Pvt. Ltd.

Banking, Finance, Accounting & Taxation

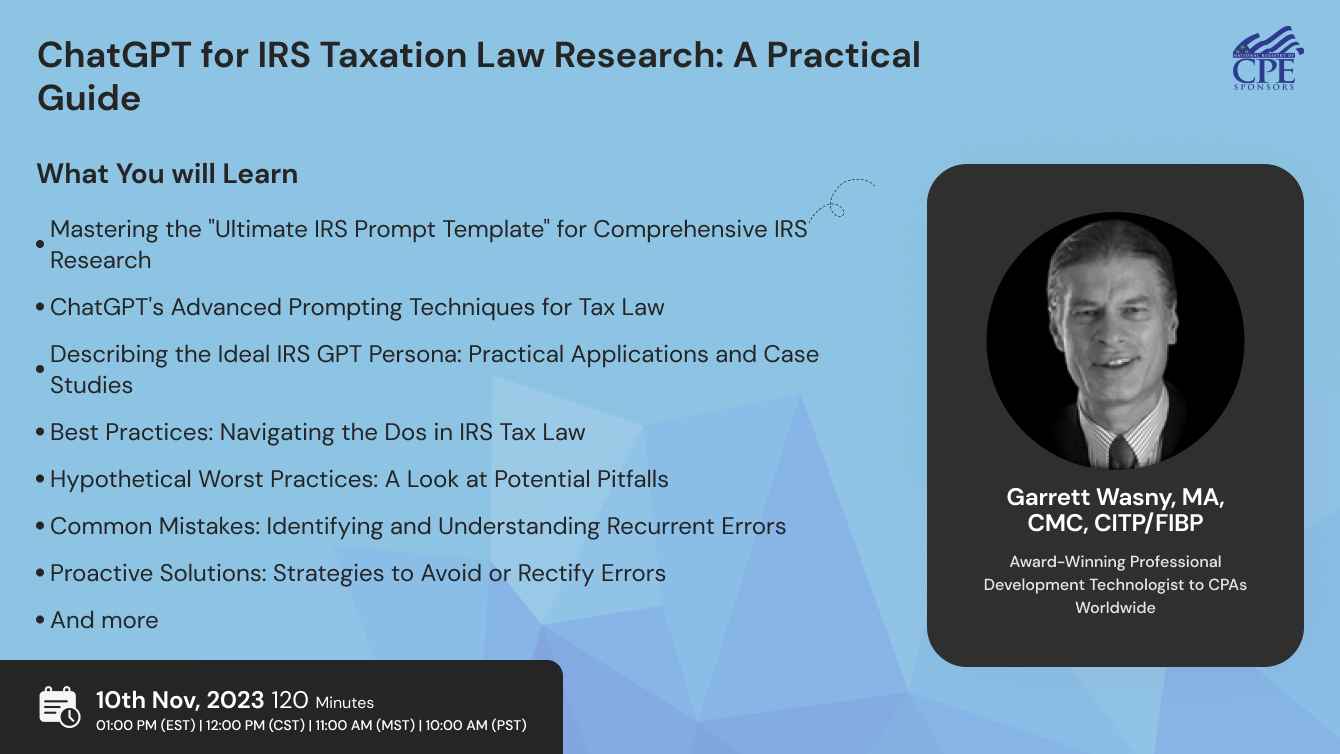

Dive into the world of ChatGPT's capabilities tailored for IRS tax law research. This course integrates the revolutionary AI chatbot technology, ChatGPT, into the intricate domain of IRS taxation. You will not only explore the foundational aspects of ChatGPT but will also gain hands-on experience in extracting valuable insights from the IRS database. Engage with a refined toolset, specifically the "Ultimate IRS Prompt Template," which caters to the unique needs of accountants handling IRS tax law matters.

- ChatGPT's Advanced Prompting Techniques for Tax Law

- Mastering the "Ultimate IRS Prompt Template" for Comprehensive IRS Research

- Describing the Ideal IRS GPT Persona: Practical Applications and Case Studies

- Best Practices: Navigating the Dos in IRS Tax Law

- Hypothetical Worst Practices: A Look at Potential Pitfalls

- Common Mistakes: Identifying and Understanding Recurrent Errors

- Proactive Solutions: Strategies to Avoid or Rectify Errors

- Delving Into the Unknown: Hidden Secrets of the IRS Tax Law

- Thinking Outside the Box: Unconventional Loophole Strategies

- Staying Informed: Comprehensive References and Authoritative Sources for IRS Information

- Analyze the components of the "Ultimate IRS Prompt Template" and evaluate its effectiveness in IRS research.

- Apply advanced prompting techniques to extract specific tax law information using ChatGPT.

- Understand the attributes of the ideal IRS GPT persona and demonstrate knowledge by interpreting practical applications through case studies.

- Recall and list the best practices in IRS tax law and justify their importance in ensuring compliance and accuracy.

- Differentiate between best and hypothetical worst practices, and predict potential pitfalls of not following recommended procedures.

- Identify common errors in IRS tax law practices and analyze the implications of such mistakes.

- Evaluate various strategies to avoid or correct errors and design a proactive plan for error prevention.

- Investigate lesser-known aspects of IRS tax law and synthesize this knowledge to improve tax law practices.

- Critique unconventional loophole strategies, assessing their potential benefits and risks in IRS tax law scenarios.

- Locate and integrate information from authoritative IRS sources to validate and enhance understanding of tax laws.

- Accountants

- CPAs

- Enrolled Agents

- Tax professionals

- Bookkeepers

- CFOs

- Office Managers

- Financial Analysts

Garrett Wasny, MA, CMC, CITP/FIBP is an award-winning Professional Development Technologist to CPAs Worldwide. Since 1995, he has delivered thousands of presentations on Internet strategy to hundreds of leading accounting institutes, industry associations, Fortune 500 companies, small and medium-sized enterprises, business schools and other legal, medical, engineering, pro sports and executive education organizations.

Garrett's writing credits include four books, dozens of e-books and hundreds of articles on online business for scores of leading business publishers, syndicates and magazines including McGraw Hill, John Wiley and Sons, Knight Ridder, the Financial Post, Journal of Commerce and World Trade.

Garrett has also won numerous awards for his writing, speaking and web design. His academic credentials include a Bachelor of Arts with Honors (BA Hons) degree and a Master of Arts (MA) degree. His professional accreditations include Certified Management Consultant (CMC), Certified International Trade Professional (CITP) and FITP (FITT International Business Professional).

In 2017, Garrett is scheduled to deliver 150+ professional development events across North America on a range of technology and accounting topics. The presentations are hosted by leading accounting CPE providers such as Thomson Reuters, CPE Solutions, CPA Crossings, CPE Link, Clear Law Institute and CPA Institutes. His courses cover online productivity, Internet search, digital transformation, mobile computing, social enterprise and tax.

Garrett is an independent Certified Management Consultant (CMC) who provides objective information based on his own impartial research and due diligence. He has more than 20 years experience in the Internet field and started his career at Price Waterhouse.

NASBA -

Compliancevent is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its web site: www.nasbaregistry.org.

Sign up now on compliancevent.net. Visit compliancevent.net/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer compliancevent to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on compliancevent.net today!

Go for the topic of your keen interest on compliancevent.net. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore compliancevent offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

compliancevent offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? compliancevent has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

compliancevent brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to compliancevent webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!