- Topics

- Webinars

- Products & Services

Welcome To Biggest Online compliance Platform By LOCGFX Pvt. Ltd.

Human Resource & Payroll

What happens when your company is located in one state and one or more of your employees work in another state? What if your company has multiple business locations, with employees in each? What happens when one or more of your employees performs services for your company in more than one state? The short answer: You have multi-state employment issues.

One of your biggest issues will revolve around payroll. Here are just some of the payroll-related issues that arise:

a) Identification of the states for which the business is liable for the collection and payment of income tax,

b) Compliance with the rules for each state regarding tax collection, payment, and reporting

c) Establishing the state that is to receive the unemployment tax for a particular employee,

d) Whether the employment creates nexus, i.e. a business presence, within a particular state and whether the employer is subject to that state’s income, franchise, sales and use, or other state business taxes imposed by the state and the related apportionment issues

Areas to be covered include, without limitation:

-Reciprocal agreements and how they affect state income tax withholding

-Employee domicile and tax residency

-State and local withholding certificates - when the federal W-4 Isn't enough

-How different states deal differently with supplemental wages

-How to handle state unemployment when employees work in several states

-What is SUTA dumping, and how do you avoid this penalty trap

-Which states get withholding tax proceeds when employees work in multiple states

-Fringe benefit taxation - which states differ from federal rules

-The payroll tax implications of conducting business in a state

-How to determine the states for which you must withhold tax

-Special rules for military spouses

-Telecommuting

-And more!

-Payroll Supervisors and Personnel

-Payroll Consultants

-Payroll Service Providers

-Public Accountants

-Internal Auditors

-Tax Compliance Officers

-Enrolled Agents

-Employee Benefits Administrators

-Officers and Managers with Payroll or Tax Compliance Oversight

-Company/Business Owners

-Managers/Supervisors

-Public Agency Managers

-Audit and Compliance Personnel /Risk Managers

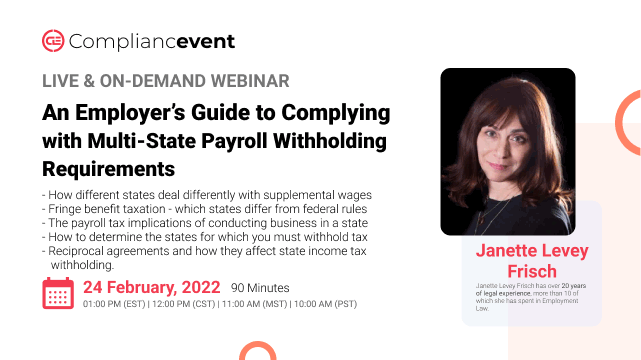

Janette Levey Frisch has over 20 years of legal experience, more than 10 of which she has spent in Employment Law. It was during her tenure as sole in-house counsel for a mid-size staffing company headquartered in Central New Jersey, with operations all over the continental US, that she truly developed her passion for Employment Law.

Janette operates under this core belief: It is possible, and it is in an employer’s best interest, to proactively solve workforce challenges before they become problems before they result in lawsuits or steep fines caused by government audits.

Janette works with employers on most employment law issues, acting as the Employer’s Legal Wellness Professional — to ensure that employers are in the best position possible to avoid litigation, audits, employee relations problems, and the attendant, often exorbitant costs. Janette authors the firm’s weekly blog, where you can read each week, in plain English (not legalese) about issues impacting employers today. Janette has written articles on many different employment law issues for many publications, including EEO Insight, B-Tank, Staffing Industry Review, @Law, and Chief Legal Officer.

Janette is a member of the Workplace Violence Prevention Institute, a multidisciplinary task force dedicated to providing proactive, holistic solutions to employers serious about promoting workplace safety and preventing workplace violence.

Janette has also spoken and trained on topics, such as Criminal Background Checks in the Hiring Process, Joint Employment, Severance Arrangements, Pre-Employment Screening among many, many others.

Compliancevent Webinar Certification - Compliancevent rewards you with Compliancevent Achievement Certification for unlocking and attending this webinar. It is to acknowledge your participation in this training session and to add more to your professional score.

Compliancevent Courses and Webinars or any Education published "Articles & Materials" strictly follows the standards and guidelines of the Professional Credit / CEU Providers and Well Researched before publishment.

Compliancevent doesn't support any Fake - News, Articles, or Compliance updates; Our Industry Experts are highly verified and recognized, and their Pre-publishment is verified via our experts and fact-checkers.

Sign up now on compliancevent.net. Visit compliancevent.net/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer compliancevent to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on compliancevent.net today!

Go for the topic of your keen interest on compliancevent.net. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore compliancevent offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

compliancevent offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? compliancevent has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

compliancevent brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to compliancevent webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!