- Topics

- Webinars

- Products & Services

Welcome To Biggest Online compliance Platform By LOCGFX Pvt. Ltd.

Human Resource & Payroll

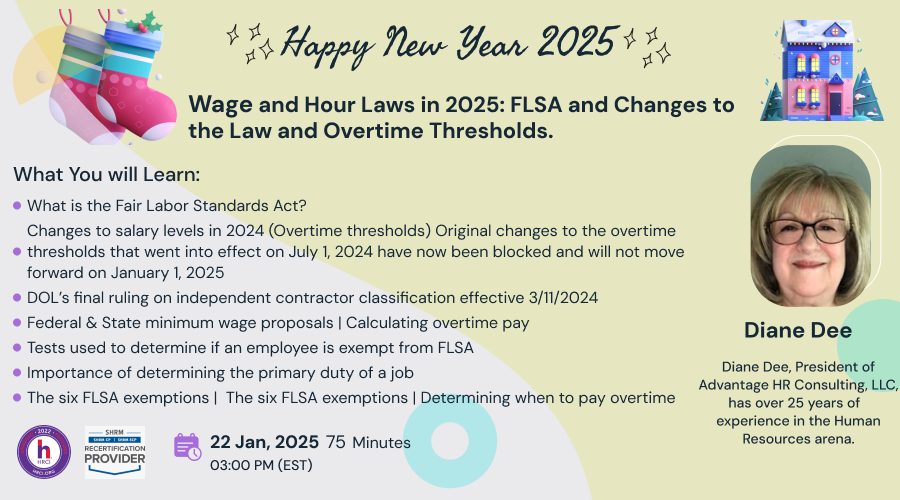

The Fair Labor Standards Act (FLSA) is a federal law that establishes minimum wage, overtime pay, equal pay, and recordkeeping standards to ensure fair treatment of employees. Notable developments in 2024 include the Department of Labor’s (DOL) final rule on independent contractor classification, effective March 11, 2024, which impacts how workers are categorized. Proposed changes to the salary level thresholds for overtime eligibility, originally set to take effect on July 1, 2024, have been blocked and will not proceed on January 1, 2025. Federal and state minimum wage proposals remain a critical area of focus, impacting pay equity and labor market conditions.

To determine FLSA exemptions, employers must evaluate the primary duties of a job and apply specific tests, including the Salary Level and Salary Basis tests.

Proper classification as exempt or non-exempt is essential to ensure compliance, as it determines overtime eligibility. Employers must also understand how to calculate overtime pay, adhere to minimum wage and equal pay provisions, and comply with and recordkeeping regulations. FLSA non-compliance can lead to significant legal and financial repercussions, making it crucial for organizations to stay informed and compliant with labor standards.

- What is the Fair Labor Standards Act?

- Changes to salary levels in 2024 (Overtime thresholds) Original changes to the overtime thresholds that went into effect on July 1, 2024 have now been blocked and will not move forward on January 1, 2025)

- DOL’s final ruling on independent contractor classification effective 3/11/2024

- Federal & State minimum wage proposals

- Tests used to determine if an employee is exempt from FLSA

- Importance of determining the primary duty of a job

- The six FLSA exemptions

- Exempt vs. Non-Exempt status

- Salary Level and Salary Basis tests

- Determining when to pay overtime

- Calculating overtime pay

- Minimum wage provisions under FLSA

- Equal pay provisions under FLSA

- Child labor regulations

- Recordkeeping requirements

- Repercussions of FLSA non-compliance

This webinar will lay the groundwork for determining whether your employees are properly classified as Exempt or Non-exempt and ensuring that wage and hour laws are being followed properly. Additionally, recent changes to the overtime thresholds will be discussed as these changes that took effect on July 1, 2024.

-Human Resources Professionals

- Compensation Professionals

- Compliance professionals

- Managers

- Supervisors

- Employees

Diane holds a Master Certificate in Human Resources from Cornell University’s School of Industrial and Labor Relations and has attained SPHR, SHRM-SCP, sHRBP, and HRPM® certification.

Diane is a member of the National Association of Women Business Owners and the Society for Human Resource Management. Additionally, Diane performs pro bono work through the Taproot Foundation, assisting non-profit clients by integrating their Human Resources goals with their corporate strategies.

SHRM -

Compliancevent recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.25 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please visit - portal.shrm.org.

HRCI -

This webinar has been approved for 1.25 HR (General) re-certification credit hours toward California, GPHR, HRBP, HRMP, PHR, and SPHR recertification through the HR Certification Institute.

The use of this seal is not an endorsement by the HR Certification Institute of the quality of the activity. It means that this activity has met the HR Certification Institute’s criteria to be pre-approved for re-certification credit.

Sign up now on compliancevent.net. Visit compliancevent.net/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer compliancevent to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on compliancevent.net today!

Go for the topic of your keen interest on compliancevent.net. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore compliancevent offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

compliancevent offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? compliancevent has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

compliancevent brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to compliancevent webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!