- Topics

- Webinars

- Products & Services

Welcome To Biggest Online compliance Platform By LOCGFX Pvt. Ltd.

Banking, Finance, Accounting & Taxation

While preparing for The US Income Tax Return for Estates & Trusts (Form 1041), it's important to understand the guidelines IRS issued to file it without any errors. In this webinar, we'll take a deep dive to explain the income, gains, deductions, losses, etc. of the estate or trust. We'll discuss the income that is either held or accumulated for future distribution or distributed currently to the beneficiaries.

You'll discover what falls into the income tax liability of the estate or trust and what guidelines we need to comply with in such conditions. We'll bunk all the myths around employment taxes on wages paid to household employees.

Many practitioners assume that “Form 1041 can’t be much different than Form 1040” but the intricacies of Subchapter J of the Internal Revenue Code are enough to overwhelm them.

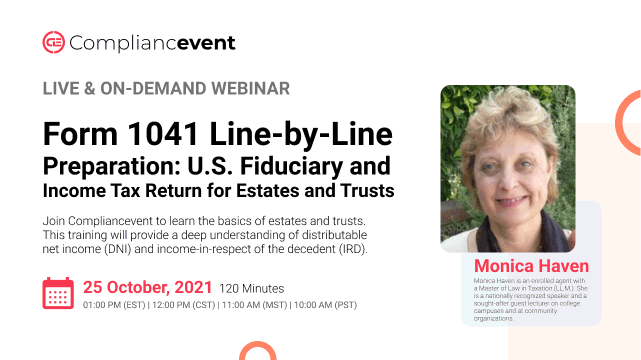

Join Compliancevent to learn the basics of estates and trusts. This training will provide a deep understanding of distributable net income (DNI) and income-in-respect of the decedent (IRD). You will get a practical guide to completing the fiduciary income tax return without any errors to minimize the chance of the IRS coming after you.

-Basics of estate planning

-Tax reporting for trusts

-Review of wealth tax regime

-Allowable tax deductions

-Trust terminations

-Income allocations

-Easy-to-use charts

-Difficult concepts made simple

-Real-life examples

-Sample IRS forms

-Understand the timeline and tax filing requirements faced by a decedent’s personal representative

-Learn the differences between accounting, distributable and taxable income

-Identify reportable items of income and deductible expenses

-Diligently and properly complete Form 1041

-Avoid mismatching important details and miscalculating deductions

-Glean information from and work with related individual and estate tax forms

-Tax practitioners

-Estate planners

-Consultants

-Attorneys

-Accountants

Monica Haven is an enrolled agent with a Master of Law in Taxation (LL.M.). She is a nationally recognized speaker and a sought-after guest lecturer on college campuses and at community organizations. She loves to teach and welcomes every opportunity to share her experience and expertise in the classroom, even as she maintains her Southern California tax practice which serves clients throughout the world. Monica’s students say she’s a “fantastic speaker” who can take “hard subjects and put them into concepts that are easy to understand.” She is “clear, articulate and expressive” and “has energy down to the last minute of the last class of the last day.” Let’s see if you agree.

Compliancevent Webinar Certification - Compliancevent rewards you with Compliancevent Achievement Certification for unlocking and attending this webinar. It is to acknowledge your participation in this training session and to add more to your professional score.

Compliancevent Courses and Webinars or any Education published "Articles & Materials" strictly follows the standards and guidelines of the Professional Credit / CEU Providers and Well Researched before publishment.

Compliancevent doesn't support any Fake - News, Articles, or Compliance updates; Our Industry Experts are highly verified and recognized, and their Pre-publishment is verified via our experts and fact-checkers.

Sign up now on compliancevent.net. Visit compliancevent.net/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer compliancevent to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on compliancevent.net today!

Go for the topic of your keen interest on compliancevent.net. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore compliancevent offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

compliancevent offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? compliancevent has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

compliancevent brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to compliancevent webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!