- Topics

- Webinars

- Products & Services

Welcome To Biggest Online compliance Platform By LOCGFX Pvt. Ltd.

Banking, Finance, Accounting & Taxation

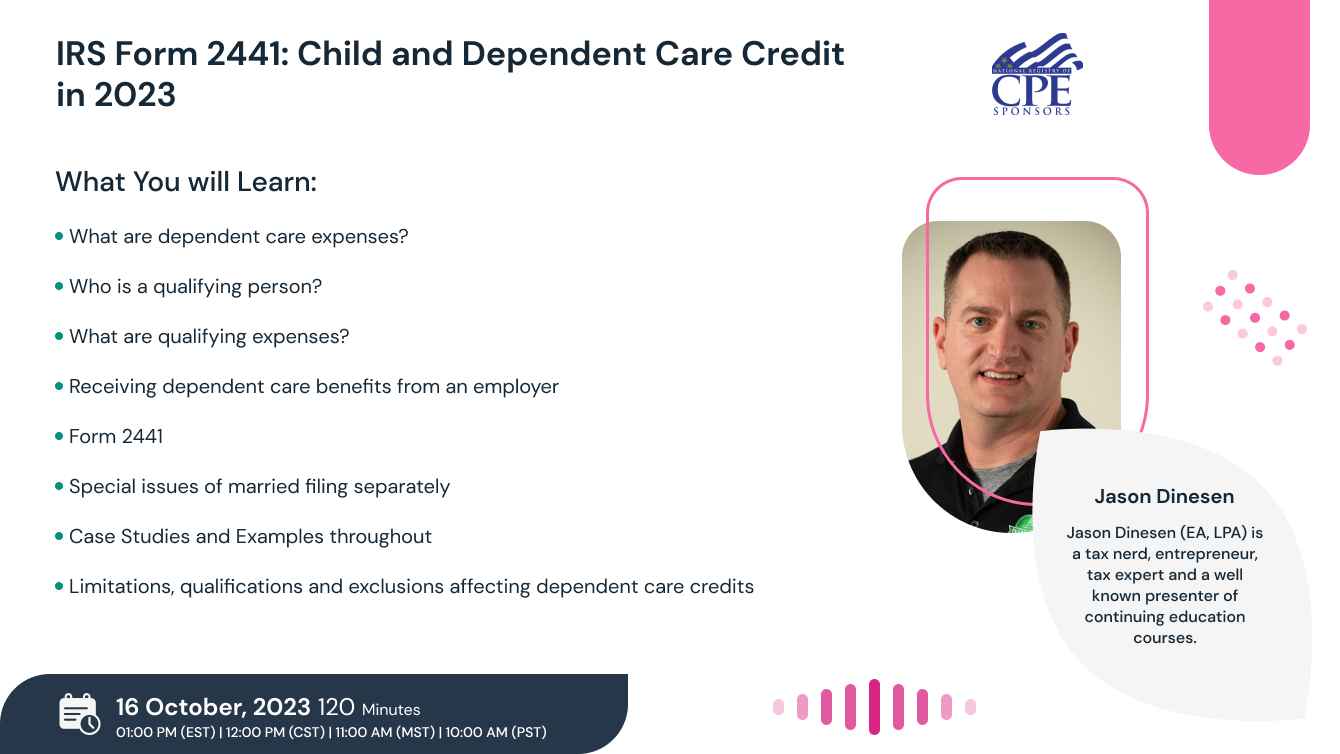

Form 2441 for Child and Dependent Care Credits on the 1040 Tax Return is a common credit for our clients. The taxpayer fills it out to declare the child and dependent care expenses incurred during the year. This form is essential if you intend to seek a credit for these care-related expenses.

While the form appears straight forward, it is more complicated than it seems, particularly when our clients lead complicated lives. There are a number of eligibility requirements they must satisfy before preparing Form 2441. Join us to discuss the completion of the form as well as scenarios and case studies highlighting credit calculations and common client complications.

- What are dependent care expenses?

- Who is a qualifying person?

- What are qualifying expenses?

- Form 2441

- Receiving dependent care benefits from an employer

- Special issues of married filing separately

- Case Studies and Examples throughout

- Special issues based on filing status

- Limitations, qualifications and exclusions affecting dependent care credits

- Understand common limitations to and exclusions from dependent care credits.

- Successfully calculate dependent care credits for common and complicated scenarios.

- Accurately complete form 2441.

- Gain confidence in discussing dependent care credit requirements with your clients.

Join us to navigate Form 2441 for Child and Dependent Care Credits on the 1040 Tax Return. This credit is often misunderstood and can be especially complex for individuals with intricate lifestyles. We aim to shed light on the intricacies of this form, covering its completion, various scenarios, and real-life case studies. Gain a deeper understanding of credit calculations and how to effectively navigate common complications that your clients may encounter.

Be a part of an in-depth discussion to enhance your expertise and knowledge, and to ensure you're maximizing the benefits of this tax credit.

- CPAs

- Accountants

- Enrolled Agents

- Tax Preparers

- Attorneys

- Tax Professionals

Jason Dinesen is the President of Dinesen Tax & Accounting, P.C., a public accounting firm in Indianola, Iowa. Jason prepares over 200 tax returns every year and deals with a variety of situations ranging from individual taxes to business taxes. He has been presenting since 2012.

NASBA -

Compliancevent is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its web site: www.nasbaregistry.org.

Sign up now on compliancevent.net. Visit compliancevent.net/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer compliancevent to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on compliancevent.net today!

Go for the topic of your keen interest on compliancevent.net. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore compliancevent offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

compliancevent offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? compliancevent has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

compliancevent brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to compliancevent webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!