- Topics

- Webinars

- Products & Services

Welcome To Biggest Online compliance Platform By LOCGFX Pvt. Ltd.

Human Resource & Payroll

Recent developments at the National Labor Relations Board (NLRB) and the U.S. Department of Labor’s Wage and Hour Division (DOL) could make it more difficult for businesses to classify workers as independent contractors. On January 6, the NLRB and the DOL announced that they entered a Memorandum of Understanding which provides for and encourages interagency cooperation through “information sharing, joint investigations and enforcement activity, training, education, and outreach.” In a separate press release, the NLRB stated that the Memorandum of Understanding “will allow for better enforcement against… misclassification of workers as independent contractors.”

Businesses that use independent contractor work would do well to pay attention to the news out of Washington, D.C., because on Oct. 11, the U.S. Department of Labor (DOL) announced its long-awaited proposed rule on contractor classification. The proposed rule would impose a six-factor “economic reality test,” with all the factors equally weighted. The six-factor test would look broadly at the “totality of the circumstances” to determine whether a worker is an independent contractor or employee under the Fair Labor Standards Act (FLSA).

According to the DOL press release, the proposed rule provides a framework more consistent with existing judicial precedent than the current rule, which was promulgated by the prior administration. Indeed, the proposed rule expressly rescinds the currently applicable rule. The public has 45 days to comment on the proposed rule once it is printed in the Federal Register on Oct. 13.

Join us on Compliancevent this December to learn the recent developments at the DOL and the NRLB that Employers must know about. Get a FREE customized compliance tool to help you become more compliant. Register today!

-How the regulatory agencies have added classification of Exempt/Non-Exempt as part of their classification audits for 2023

-Why the DOL and NLRB working together on this workplace issue

-What other regulatory agencies are creating their own version of Independent Contractor rules

-What are the penalties for violating classification regulations by the DOL, NLRB and IRS?

-What are the several rules that Employers need to follow to stay compliant with classification?

-What do the “proposed rules” include and which proposal can make challenges for Employers and agents of employers like professionals involved in employee relations?

-What are the best practices when classifying employees vs independent contractors?

-How can Employers and Professionals provide their feedback before the regulations are in place?

-How long do Employers have to put the new rule in place?

-How can Employers effectively mitigate the proposed regulations?

These developments at the DOL and the NLRB could mean trouble for employers that misclassify workers as independent contractors.

For example, an NLRB investigation of an unfair labor practice that leads to the conclusion that certain workers have been misclassified as employees could lead to the DOL finding a company is liable for unpaid overtime and minimum wages.

Considering this heightened scrutiny and potential narrower legal standard, it is now more important than ever to evaluate how companies structure an independent contractor relationship.

It is particularly important for employers to seek guidance from experienced counsel when developing and implementing policies related to working with independent contractors.

As the DOL, the IRS, the NLRB, and various other federal and state agencies have their own tests for determining independent contractor vs. employee status for various reasons, employers have a keen interest in staying apprised of the developments in this area of employment law.

-All Employers

-Business Owners

-Company Leadership

-Compliance professionals

-Payroll Administrators

-HR Professionals

-Managers/Supervisors

-Anyone interested in being compliant with current regulations

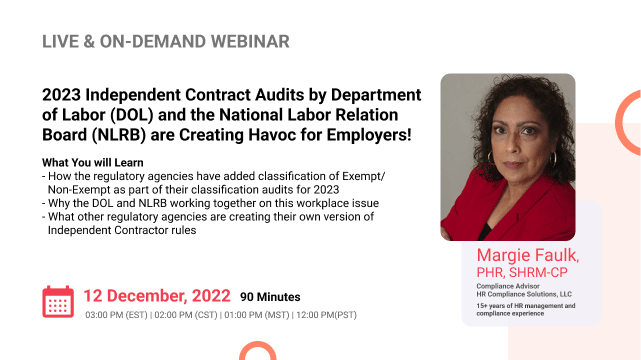

Margie Faulk is a senior level human resources professional with over 15 years of HR management and compliance experience. A current Compliance Advisor for HR Compliance Solutions, LLC, Margie, has worked as an HR Compliance advisor for major corporations and small businesses in the small, large, private, public, Non-profit sectors and International compliance. Margie has provided small to large businesses with risk management strategies that protect companies and reduces potential workplace fines and penalties from violation of employment regulations. Margie is bilingual (Spanish) fluent and Bi-cultural. Margie’s area of expertise includes Criminal Background Screening Policies and auditing, I-9 document correction and storage compliance, Immigration compliance, employee handbook development, policy development, sexual harassment investigations/certified training, SOX regulations, payroll compliance, compliance consulting, monitoring US-based federal, state and local regulations, employee relations issues, internal investigations, HR management, compliance consulting, internal/external audits, and performance management. Margie’s unique training philosophy includes providing free customized tools for all attendees. These tools are customized and have been proven to be part an effective risk management strategy. Some of the customized tools include the I-9 Self Audit. Correction and Storage program, Ban the Box Decision Matrix Policy that Employers can provide in a dispute for allegations, Family Medical Leave Act (FMLA) Compliance Guide, Drug-Free Workplace Volatile Termination E-Book and other compliance program tools when attendees register and attend Margie’s trainings. Margie holds professional human resources certification (PHR) from the HR Certification Institution (HRCI) and SHRM-CP certification from the Society for Human Resources Management. Margie is a member of the Society of Corporate Compliance & Ethics (SCCE).

Compliancevent Webinar Certification - Compliancevent rewards you with Compliancevent Achievement Certification for unlocking and attending this webinar. It is to acknowledge your participation in this training session and to add more to your professional score.

Compliancevent Courses and Webinars or any Education published "Articles & Materials" strictly follows the standards and guidelines of the Professional Credit / CEU Providers and Well Researched before publishment.

Compliancevent doesn't support any Fake - News, Articles, or Compliance updates; Our Industry Experts are highly verified and recognized, and their Pre-publishment is verified via our experts and fact-checkers.

Sign up now on compliancevent.net. Visit compliancevent.net/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer compliancevent to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on compliancevent.net today!

Go for the topic of your keen interest on compliancevent.net. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore compliancevent offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

compliancevent offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? compliancevent has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

compliancevent brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to compliancevent webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!