- Topics

- Webinars

- Products & Services

Welcome To Biggest Online compliance Platform By LOCGFX Pvt. Ltd.

Human Resource & Payroll

The American Rescue Plan Act issues some guidelines to offer tax credits for employers, who provide voluntary Emergency Paid Leave. The ARPA extends the availability of the tax credits to those employers who qualify and voluntarily provide employees with EPSL and/or EFML through September 30, 2021. It will enable employers to receive tax credits for these benefits.

With IRS Form 941 and 941-X having their deadlines right around the corner, it is high time to learn that they are the way to collect the tax credits. Many employers now look forward to accurately calculating these tax credits to ensure they receive the tax credit amount, but how should they do it?

Some employers are already familiar with the form 941 but not all are able to complete it with confidence on all steps. Considering the fact that there have been many reported errors, it is an additional concern to complete the 941-X corrections appropriately to ensure compliance and avoid fines, penalties, and criminal sanctions.

Join Compliancevent to learn how to correctly fill the IRS Form 941 as well as the requirements you need to meet to eliminate previous form errors through the Form 941-X. Our certified expert will provide a line-by-line description as recommended by the IRS.

Employers need to have proper knowledge before they are able to fill any IRS form. With Form 941 Quarter 2 being a hot topic these days, you need to ensure a correct approach to file it. However, for those having errors in the previous 941 filings, it is important to know how the Form 941-X can help you correct them.

The best compliance practice is for employers to learn how to mitigate the processes that impact their company. From payroll employees to payroll providers, it is critical that employers use all available resources to make sure they follow all the necessary protocols to complete these IRS forms.

This webinar will provide employers and payroll professionals an insight into how to complete the forms to ensure you maximize the tax credits offered by the ARPA and give the employees transparency and confidence.

-What are Forms 941 and 941-X and what is the difference between the two?

-The major changes from the Family First Coronavirus Response Act (FFCRA)

-What has the American Rescue Plan Act (ARPA) removed and added for employers during COVID-19?

-What other tax credits are available under the ARPA?

-Why is it important for employers to learn to complete the 941 forms and if necessary, the 941-X?

-What's the role of Form 941-X?

-How can employers effectively communicate the necessary changes to their employees?

-How are the Employee Retention tax credits a benefit for employers and employees?

-A step-by-step guideline and discussion to effectively complete Form 941 without mistakes

-The necessary steps to take when completing the Forms 941 and 941-X

-What errors in the previous forms can be corrected by form 941-X?

-The right way for employers to coordinate with their payroll provider to ensure compliance and accuracy

-This Program, ID No. 562008, has been approved for 1.50 HR (General) recertification credit hours toward aPHR™, aPHRi™, PHR®, PHRca®, SPHR®, GPHR®, PHRi™, and SPHRi™ recertification through HR Certification Institute® (HRCI®).

-This program is valid for 1.5 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please portal.shrm.org.

-Payroll managers

-Payroll professionals

-HR executives

-HR professionals

-HR managers

-HR directors

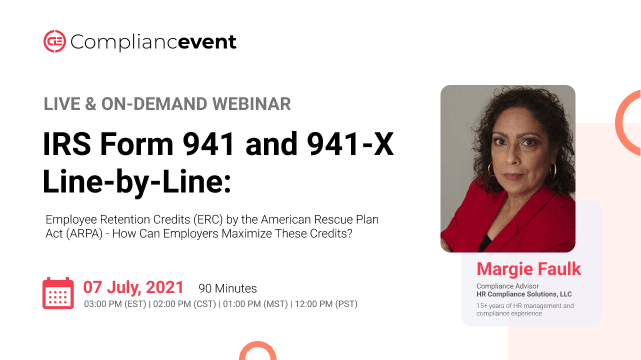

Margie Faulk is a senior level human resources professional with over 15 years of HR management and compliance experience. A current Compliance Advisor for HR Compliance Solutions, LLC, Margie, has worked as an HR Compliance advisor for major corporations and small businesses in the small, large, private, public, Non-profit sectors and International compliance. Margie has provided small to large businesses with risk management strategies that protect companies and reduces potential workplace fines and penalties from violation of employment regulations. Margie is bilingual (Spanish) fluent and Bi-cultural. Margie’s area of expertise includes Criminal Background Screening Policies and auditing, I-9 document correction and storage compliance, Immigration compliance, employee handbook development, policy development, sexual harassment investigations/certified training, SOX regulations, payroll compliance, compliance consulting, monitoring US-based federal, state and local regulations, employee relations issues, internal investigations, HR management, compliance consulting, internal/external audits, and performance management. Margie’s unique training philosophy includes providing free customized tools for all attendees. These tools are customized and have been proven to be part an effective risk management strategy. Some of the customized tools include the I-9 Self Audit. Correction and Storage program, Ban the Box Decision Matrix Policy that Employers can provide in a dispute for allegations, Family Medical Leave Act (FMLA) Compliance Guide, Drug-Free Workplace Volatile Termination E-Book and other compliance program tools when attendees register and attend Margie’s trainings. Margie holds professional human resources certification (PHR) from the HR Certification Institution (HRCI) and SHRM-CP certification from the Society for Human Resources Management. Margie is a member of the Society of Corporate Compliance & Ethics (SCCE).

Compliancevent Webinar Certification - Compliancevent rewards you with Compliancevent Achievement Certification for unlocking and attending this webinar. It is to acknowledge your participation in this training session and to add more to your professional score.

Compliancevent Courses and Webinars or any Education published "Articles & Materials" strictly follows the standards and guidelines of the Professional Credit / CEU Providers and Well Researched before publishment.

Compliancevent doesn't support any Fake - News, Articles, or Compliance updates; Our Industry Experts are highly verified and recognized, and their Pre-publishment is verified via our experts and fact-checkers.

Sign up now on compliancevent.net. Visit compliancevent.net/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer compliancevent to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on compliancevent.net today!

Go for the topic of your keen interest on compliancevent.net. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore compliancevent offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

compliancevent offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? compliancevent has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

compliancevent brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to compliancevent webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!