- Topics

- Webinars

- Products & Services

Welcome To Biggest Online compliance Platform By LOCGFX Pvt. Ltd.

Banking, Finance, Accounting & Taxation

On 7th September, the Treasury Department and the IRS issued Notice 2021-53 for Employers to guide them report on Form W-2 the amount of qualified sick and family leave wages paid to employees for leave taken in 2021.

The update provides guidance under recent legislation, including: the Families First Coronavirus Response Act (FFCRA), as amended by the COVID-Related Tax Relief Act of 2020, and the American Rescue Plan Act of 2021.

So the September guidance requires the Employers to report these amounts to employees either on Form W-2, Box 14, or in a separate statement provided with the Form W-2.

It is to provide employers with model language to use as part of the Instructions for Employee for the Form W-2 or on the separate statement provided with the Form W-2.

The wage amount that the notice requires employers to report on Form W-2 will provide employees who are also self-employed with the information necessary to determine the amount of any sick and family leave equivalent credits they may claim in their self-employed capacities.

Now, it is important to know the IRS' take before we discuss the approach for ERC.

-What are ERC and FFCRA?

-Step-by-step through the ERC, from qualifying to calculating the credit

-What new approaches this IRS guidance bring?

-How to claim ERC on Form 941, Form 7200, and Form 941-X?

-What is FFCRA?

-How to claim FFCRA?

-How PPP loans interact with ERC and FFCRA?

-COBRA credits, restaurant revitalization fund, and shuttered venues operators grants: how it all ties together with ERC and PPP

-Reporting on tax returns

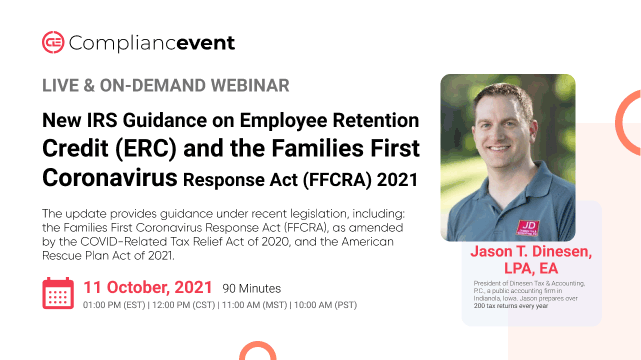

This training session will cover the latest with the employee retention credit and the Families First Coronavirus Response Act (FFCRA). ERC has changed multiple times since its inception, and continues to change, with 3 pieces of IRS guidance released in August and September of 2021. New guidance recently came out about FFCRA reporting for 2021 as well.

-Business owners

-Tax professionals

-Office managers

-Payroll professionals

-Controllers

-Bookkeepers

-Managers

-CFOs

-Accountants

Jason Dinesen is the President of Dinesen Tax & Accounting, P.C., a public accounting firm in Indianola, Iowa. Jason prepares over 200 tax returns every year and deals with a variety of situations ranging from individual taxes to business taxes. He has been presenting since 2012.

Compliancevent Webinar Certification - Compliancevent rewards you with Compliancevent Achievement Certification for unlocking and attending this webinar. It is to acknowledge your participation in this training session and to add more to your professional score.

Compliancevent Courses and Webinars or any Education published "Articles & Materials" strictly follows the standards and guidelines of the Professional Credit / CEU Providers and Well Researched before publishment.

Compliancevent doesn't support any Fake - News, Articles, or Compliance updates; Our Industry Experts are highly verified and recognized, and their Pre-publishment is verified via our experts and fact-checkers.

Sign up now on compliancevent.net. Visit compliancevent.net/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer compliancevent to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on compliancevent.net today!

Go for the topic of your keen interest on compliancevent.net. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore compliancevent offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

compliancevent offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? compliancevent has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

compliancevent brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to compliancevent webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!