- Topics

- Webinars

- Products & Services

Welcome To Biggest Online compliance Platform By LOCGFX Pvt. Ltd.

Banking, Finance, Accounting & Taxation

The Form W-4 has changed. The Tax Cuts and Jobs Act introduced many tax rules in 2017 that promoted IRS to significantly change Form W-4 last year. How's this year's W-4 filing different? What steps do you have to take to file it before late January 2022? How do the changes affect employee claims, withholding allowances, and personal exemptions?

Form W-2 might also be tricky to understand if you're subjected to this filing. As the IRS matches the reported payment amounts with your employer's corporate tax return, you've to ensure the integrity of the information you provide. It's also important to know what portion of the income is subject to the Social Security tax.

How do your excess contributions to a qualified retirement plan and a health savings account affect this filing? Why do you have to be really cautious with the name, SSN, EIN, and tax year on your Form W-2? What happens if there's an incorrect reduction in federal tax withholding in connection with a gross-up after the tax year closes? Can you report an error on a W-2?

Can you still request advance payment of employer credits? What's the criteria for qualified sick and family leave wages, ERC, and the COBRA premium assistance credit (subsidy)? Does the Form 7200 remain the same as issued by the IRS last year? How do you fill it?

Join us on Compliancevent to get answers to all these and many more. This training will provide the latest updates on Form W-4 and Form W-2 wage and withholding reporting. You'll learn to prepare your staff for this filing year, improve your employee reporting set-up and maintenance practices, and reduce your risk of complaints from the IRS.

You'll have your expert, a CGMA, review with you the current laws and regulations regarding the Form W-2 and Form W-4 filing. You'll also get practical guidance in the areas that have become the subject of increasing IRS scrutiny.

The IRS is changing the rules in regulatory reporting once again. What requirements do you have to meet to claim your exempt status? How can you electronically file with the SSA using Business Services Online (BSO)? How to calculate the allowances? What's the liability criteria? What penalties could you meet?

Join us to review with us the current Forms W-4 and W-2 and related issues to prepare yourself for a smooth and error-free reporting season.

-What are legal and regulatory changes for the reporting year?

-How does the Tax Credits and Jobs Act affect your filing?

-What are the benefits/credits about to expire?

-Updated forms, including the new form W-4 (no longer based on exemption allowances)

-How to efficiently execute an electronic W-4 program?

-How to verify employee social security numbers (SSNs) online?

-Retirement funding – new thresholds

-How to handle expense reimbursements made to employees - reportable/taxable?

-Reporting the cost of employer-sponsored health coverage: which employers are affected, when employers must begin reporting, what to report, valuation methods, etc.

-Can you still apply for advance credits using Form 7200 and how?

-What are the benefits and requirements of electronic filing with the SSA using Business Services Online (BSO)?

-Where to turn when you want to transmit employee copies of W-2’s electronically?

-What if you make a mistake? What are the correction procedures and penalties involved?

-What can your company do to minimize resource consumption when complying with this regulatory reporting requirement?

-Accountants

-Payroll personnel

-Accounts Payable personnel

-CFOs

-Human Resources

-Tax Managers

-Tax Attorneys

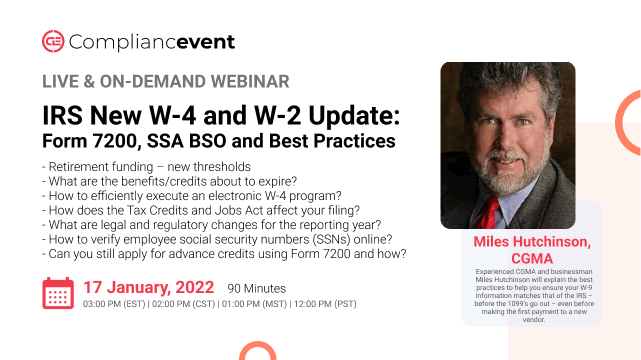

Miles Hutchinson is a CGMA and experienced businessman. He has been an auditor with PriceWaterhouseCoopers and the Chief Financial Officer of a $1 billion real estate development company. Miles is a highly sought after professional speaker and consultant who has presented over 2,500 seminars and training sessions on a myriad of business and financial topics, such as tax, financial analysis and modeling, accounting matters, strategic planning, and compliance with the Sarbanes-Oxley Act. His clients include, Abbott Labs, BASF, Citicorp, the FBI, GE, Pfizer, Siemens, and the US Marine Corps.

Compliancevent Webinar Certification - Compliancevent rewards you with Compliancevent Achievement Certification for unlocking and attending this webinar. It is to acknowledge your participation in this training session and to add more to your professional score.

Compliancevent Courses and Webinars or any Education published "Articles & Materials" strictly follows the standards and guidelines of the Professional Credit / CEU Providers and Well Researched before publishment.

Compliancevent doesn't support any Fake - News, Articles, or Compliance updates; Our Industry Experts are highly verified and recognized, and their Pre-publishment is verified via our experts and fact-checkers.

Sign up now on compliancevent.net. Visit compliancevent.net/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer compliancevent to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on compliancevent.net today!

Go for the topic of your keen interest on compliancevent.net. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore compliancevent offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

compliancevent offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? compliancevent has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

compliancevent brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to compliancevent webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!