- Topics

- Webinars

- Products & Services

Welcome To Biggest Online compliance Platform By LOCGFX Pvt. Ltd.

Human Resource & Payroll

You will get the complete and simplified context of payroll rules and administration. We'll start with how you can classify workers as Contractors or Workers on the basis of DOL rulings and what impact does it make? You'll then learn about the rules for administration and payment of Contractors, along with the rules for payments to "Exempt" and "Nonexempt" workers based on DOL/ FLSA. We'll also discuss the record-keeping and reporting for all employees.

Why is payroll administration only accepted if perfect, and how can we achieve that perfection? We'll consider the understanding and implementation of the Dept of Labor's new proposed overtime rules. You'll see how these overtime rules work for the nonexempt classification, as now more employees will be eligible for overtime causing an increase in administration and costs.

As COVID-19 challenges come into the picture, we'll learn how things will change from October 2021 onwards. This includes regulations of all jobs and descriptions, policies and procedures, and handbooks. This major implementation will also have a cultural impact as employees must be moved to different classifications for compliance.

What are the new federal employee minimum wage guidelines and what impact will they create? What's the new guidance DOD salary limits for Exempt employees and the consequences of more employees being classified as non-exempt? On Compliancevent, you'll get answers to all these through a 6-step review and much more.

Having a just payroll system is essential for any business and your employees' morale. In this training, you'll learn the payroll rules under the FLSA and how to effectively implement them to achieve perfection. It is a simple approach to administration and is guaranteed to give attendees a good working and industry knowledge in an easy-to-understand way to help them apply these tools and techniques.

-Proper classification of employees as exempt or non-exempt based on new DOL salary limits for Exempt employees

-A complete section is devoted to the understanding & implementation of the new DOL overtime and salary rules

-The recent executive order on minimum wage for Federal workers: Executive order 14026 signed by President Biden in 2021.

-Limit raised from $23,000 to $36,000 making more employees eligible for overtime and the administrative

-What's the importance of job description in the implementation of new rules?

-How can you implement the FLSA rules?

-Proper payment of exempt and non-exempt under FLSA rules

-Achieving perfection and prevention consistent with the implementation of FLSA rules and the effect on the payroll administration

-Identifying employees as exempt from overtime using FLSA rules in the categories of executive, administration, professional, computer professionals, outside sales professionals, and salary and duties test under FLSA for exempt employees

-Recordkeeping, accounting & reporting, policies & procedures

-Proper payment to newly classified exempt and those that by default fall to the non-exempt category

-How to handle non-discretionary bonuses consistent with paying overtime and the new overtime rules?

-Possible reclassification of employees from exempt to non-exempt based on the salary threshold

-PR professionals

-HR Personnel

-Managers

-Controllers

-Supervisors

-Planning and budgeting professionals

-All positions involved in personnel or payroll administration and the supervision of personnel

-ALL with the function and responsibility for payroll (payment of employees, contractors, and Administration.

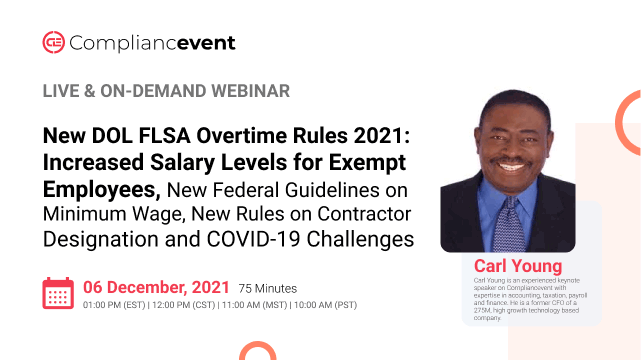

Carl Young is an experienced keynote speaker on Compliancevent with expertise in accounting, taxation, payroll, and finance. He is a former CFO of a 275M, high-growth technology-based company. He has over 25 years of senior-level business management experience. In addition, he has over 25 years of training experience in finance, accounting, and business management. Former CEO of his own small parts manufacturing company as well as former Senior Financial Associate of a major consulting firm.

Carl is a member of the following organizations: American Society of Corporate Controllers, Council of Experts (investment firm Gerson & Lehrman), Society of Industry Leaders (sponsored by Standard & Poors), and the National Association of Accountants. He's an engaging and entertaining speaker and trainer who draws from his experience as a former CFO to make relevant teaching points.

Carl is also an author, trainer, consultant, and coach. He holds an MBA and completed graduate studies in Accounting and Taxation. His sessions are rich in content, lively, full of energy and include plenty of audience interaction. His goal is to make finance and accounting relevant to non-financial professionals using tools and techniques that are simple to understand and apply. His entire working career has involved the administration of payroll to employees.

Compliancevent Webinar Certification - Compliancevent rewards you with Compliancevent Achievement Certification for unlocking and attending this webinar. It is to acknowledge your participation in this training session and to add more to your professional score.

Compliancevent Courses and Webinars or any Education published "Articles & Materials" strictly follows the standards and guidelines of the Professional Credit / CEU Providers and Well Researched before publishment.

Compliancevent doesn't support any Fake - News, Articles, or Compliance updates; Our Industry Experts are highly verified and recognized, and their Pre-publishment is verified via our experts and fact-checkers.

Sign up now on compliancevent.net. Visit compliancevent.net/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer compliancevent to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on compliancevent.net today!

Go for the topic of your keen interest on compliancevent.net. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore compliancevent offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

compliancevent offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? compliancevent has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

compliancevent brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to compliancevent webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!