- Topics

- Webinars

- Products & Services

Welcome To Biggest Online compliance Platform By LOCGFX Pvt. Ltd.

Human Resource & Payroll

More companies are now expanding their recruiting worldwide to find the best talent, it is becoming more and more critical for payroll professionals to understand non-immigrant concerns and how it affects how we pay employees, from taxes that need to accounted for in the US and in the foreign country.

As a payroll professional when you have been told by your HR department that they hired a new associate with an H1B Visa. Your response probably was – ok so what does that mean? This webinar will help the participant know what documentation to look for and how the IRS defines taxation. Details of international pay policies and taxation will also be reviewed.

-Why it is critical for HR and payroll to work together on anyone being hired that is on a visa status.

-Understanding the Visa process from how companies obtain a visa for a potential employee to how to handle employees already on visas when being hired.

-Understanding taxation concerns for non-immigrant workers

-How to manage nonresident alien payee' tax issues efficiently

-Discussions on what is an I-94 Card and how to review them.

-Details of different types of Work Visa’s such as L-1, E, O, H-1, TN/NAFTA

-Details of different types of Student visas such as F-1 & J-1

-Tax Equalization and Tax Protection Plans

-Having a solid Hypothetical Tax Plan

-Develop an effective plan to improve your company's regulatory compliance

-How to make your backup withholding deposits timely and keep the IRS from confusing them with your payroll tax and other withholding deposits

After attending this webinar, you will –

-Learn more about international and US taxation for temporary workers

-Able to identify your NRA payees and bring your company into compliance Understand the difference between DOL Rules and IRS Rules for temporary workers in the US

-Get better understanding of IRA approved tax policies and how they impact the employee and employer.

-Recognize how to develop an effective plan to move your company, institution or clients toward complete regulatory compliance, efficiency improvements, standardized processes and adequate documentation, to ensure NRAs are properly handled according to IRS and tax treaty regulations

-Payroll professionals

-HR Professionals

-Compensation Professionals

-Accounting Professionals

-Taxation professionals

-Bookkeepers & Accountants & Tax Preparers

-Compliance Officers

-Information Reporting Officers

-Tax Managers

-CFOs

-Controllers

-Accounting Managers

-Auditors

-IT Managers

-Compliance Managers

-Risk Managers.

This Online Education Tax Course is recommended for CPA, EA, AFSP, CRTP, MRTP, ORTP, CFIRS, CWS, SHRM, HRCI, CMA, and any other tax professionals who want to understand everything about Resident & Non-Resident Alien Payroll.

This CE/CPE webinar is also helpful for desiring to update themselves about payroll-related matters.

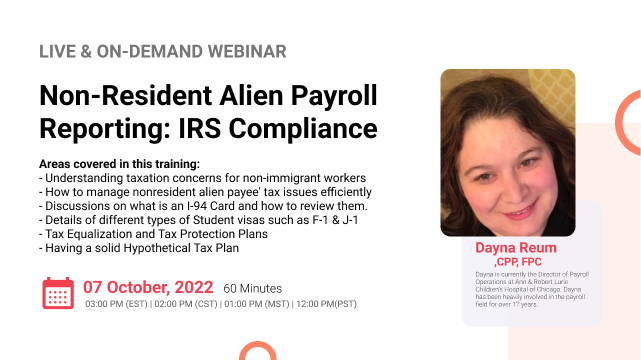

Dayna is currently the Director of Payroll Operations at Ann & Robert Lurie Children’s Hospital of Chicago. Dayna has been heavily involved in the payroll field for over 17 years. Starting as a payroll clerk at a small Tucson company, Dayna moved on to be a Payroll Team Leader at Honeywell Inc. During Dayna’s time at Honeywell she obtained her FPC (Fundamental Payroll Certification) through the American Payroll Association. She also received several merit awards for Customer Service and Acquisitions and Divestitures.

Dayna is no stranger to teaching she has taught at the Metro Phoenix American Payroll Association meetings and at the Arizona State Payroll Conference. Topics including Payroll Basics, Global/Cultural Awareness, Immigration Basics for the Payroll Professional, Multi-State and Local Taxation and Quality Control for Payroll, International and Canadian payroll. Dayna has her CPP (Certified Payroll Professional) through the APA. She also serves on the National American Payroll Association on the National Strategic Leadership Task Force, Government Affairs Task Force (PA Local tax subcommittee). Dayna has received a Citation of Merit for her service along with being a Gold Pin member of the APA. Besides her payroll accomplishments, Dayna is certified in HR hiring and firing practices and is a Six-Sigma Greenbelt.

Compliancevent Webinar Certification - Compliancevent rewards you with Compliancevent Achievement Certification for unlocking and attending this webinar. It is to acknowledge your participation in this training session and to add more to your professional score.

Compliancevent Courses and Webinars or any Education published "Articles & Materials" strictly follows the standards and guidelines of the Professional Credit / CEU Providers and Well Researched before publishment.

Compliancevent doesn't support any Fake - News, Articles, or Compliance updates; Our Industry Experts are highly verified and recognized, and their Pre-publishment is verified via our experts and fact-checkers.

Sign up now on compliancevent.net. Visit compliancevent.net/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer compliancevent to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on compliancevent.net today!

Go for the topic of your keen interest on compliancevent.net. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore compliancevent offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

compliancevent offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? compliancevent has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

compliancevent brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to compliancevent webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!