- Topics

- Webinars

- Products & Services

Welcome To Biggest Online compliance Platform By LOCGFX Pvt. Ltd.

Human Resource & Payroll

Preparing for year-end should not begin in October or November as it may have in the past. Preparation should begin in January and be conducted throughout the calendar year. This is especially important now as the IRS is looking at year-end compliance issues. In this webinar, we will give the latest best practices to help your payroll department transition from a year-end crunch to a smooth and compliant year-end process. We will discuss how check lists can help keep you on track to ensure all tasks are completed. How a simple two-page memo can prevent dozens of employee questions. We will cover how your duplicate Form W-2 request form and procedures should be set up and in place in advance of issuing the forms and how it will assist you when processing those requests in the upcoming year.

We will provide examples of check lists that should be prepared for each year-end to assist in a smooth transition. We will also provide updates for the calendar year 2022 on such items as social security wage base, deferred compensation limits, mileage rates, and Forms W-2 and 941. This webinar will provide a sample of a form to request a duplicate Form W-2 that can be used by the attendee in their own department as well as information on setting up the procedures for requesting the form. We will discuss how to work throughout the year to collect information from accounts payable for year-end instead of trying to obtain all the information in December.

We will also cover any late-breaking legislation/regulation changes—including COVID-19 reporting changes to Form W-2

-Latest update on the Form W-4 for 2022!

-Reconciliation of Form W-2 to Form 941 and why it must be done

-Update on year-beginning annual changes for social security wage base, fringe benefit limitations, federal per diem allowance, standard mileage rate, qualified transportation fringe benefits, and more.

-How to use the required year-end notice to update your employees for the coming year

-Best practices on organizing the payroll department for year-end including action item check lists for Form W-2, Year-end, and Year beginning to ensure a smooth process

-How to handle duplicate requests for Form W-2 including charging fees

-Status review of Publication 1494 for 2022

-Changes to Form W-2 for 2021& Expected changes for the year 2022

-Best practices for gathering, calculating, and reconciling W-2 data all year long as is now expected by the IRS

-Taxation of fringe benefits for year-end including awards and prizes, personal use of company cars, and gift certificates

-Latest update on white-collar exemptions

-Electronic delivery of W-2s to employees

-When to use the Form W-2c and when to correct the W-2 itself

-State regulatory changes affecting payroll including SUI wage bases, minimum wage increases, and more

-Review of EFW-2 record changes for the tax year 2021

-Verifying employee names and SSN’s

-Review of filing deadlines

-Third-Party Sick Pay reporting

This webinar concentrates on preparing the department for the end of the calendar tax year and the New Year processing. Topics include reconciling, completing, and submitting Form W-2 federal and state; update to annual changes from the IRS, SSA, DOL, and on the state level; and best practices that will help make the year-end and year beginning go smoother. We will demonstrate how this helps smooth out the year-end processing and relieve year-end stress for both departments. We will provide the basis for a year-end memo to help payroll departments inform the company’s employees of what lies ahead for the upcoming year to help curtail questions during this hectic time for payroll.

-Payroll Executives/ Managers/ Administrators/ Professionals/ Practitioners/ Entry Level Personnel

-Human Resources Executives/ Managers/Administrators

-Accounting Personnel

-Business Owners/ Executive Officers/ Operations and Departmental Managers Lawmakers

-Attorneys/ Legal Professionals

-Any individual or entity that must deal with the complexities and requirements of Payroll compliance issues for Year-End closing and preparing for the upcoming year.

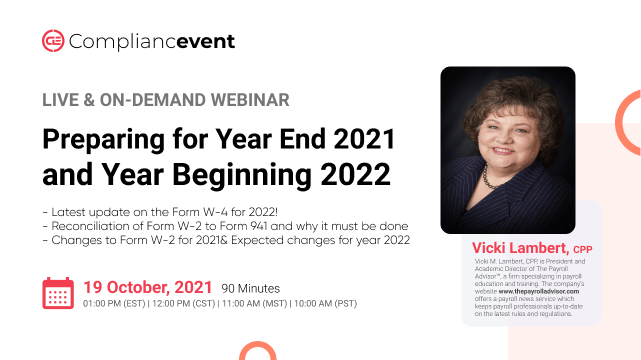

Vicki M. Lambert, CPP,

is President and Academic Director of The Payroll Advisor™, a firm specializing

in payroll education and training. The company’s website www.thepayrolladvisor.com offers a payroll news

service which keeps payroll professionals up-to-date on the latest rules and

regulations.

With nearly 40 years of hands-on experience in all facets of payroll

functions as well as over three decades as a trainer and author, Ms. Lambert

has become the most sought-after and respected voice in the practice and

management of payroll issues. She has

conducted open market training seminars on payroll issues across the United

States that have been attended by executives and professionals from some of the

most prestigious firms in business today.

A pioneer in electronic and online education, Ms.

Lambert produces and presents payroll-related audio seminars, webinars, and

webcasts for clients, APA chapters, and business groups throughout the country.

Ms. Lambert is an adjunct faculty member at Brandman University in Southern

California and is the creator of and instructor for their Practical Payroll

Online program, which is approved for recertification hours by the APA. She is

also the instructor for the American Payroll Association’s “PayTrain” online program

also offered by Brandman University.

Compliancevent Webinar Certification - Compliancevent rewards you with Compliancevent Achievement Certification for unlocking and attending this webinar. It is to acknowledge your participation in this training session and to add more to your professional score.

Compliancevent Courses and Webinars or any Education published "Articles & Materials" strictly follows the standards and guidelines of the Professional Credit / CEU Providers and Well Researched before publishment.

Compliancevent doesn't support any Fake - News, Articles, or Compliance updates; Our Industry Experts are highly verified and recognized, and their Pre-publishment is verified via our experts and fact-checkers.

Sign up now on compliancevent.net. Visit compliancevent.net/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer compliancevent to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on compliancevent.net today!

Go for the topic of your keen interest on compliancevent.net. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore compliancevent offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

compliancevent offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? compliancevent has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

compliancevent brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to compliancevent webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!